These are a few of the exciting internet banking security features that banks are keeping you safe from banking scams in 2025. We often cover the doom and gloom of internet scams, reminding readers to secure their accounts and use strong passwords. With Kiwis losing over $1.6 billion to online threats in 2024, it’s clear scams are a serious risk. But 2025 is looking brighter; banks are introducing new tools and protections to help keep your hard-earned money safer than ever.

Discover our favourite internet banking security features from Kiwi banks. Make sure that if you’re a customer, you make the most of these exciting new features. This is not an exhaustive list, so be sure to research what security features your bank has.

One major feature that has now rolled out to all major Kiwi banks is Confirmation of Payee. You’d have likely noticed this if you’ve recently paid someone new. This is when the banking app or website checks to make sure the name and account details match up, ensuring you’re not paying the wrong person.

New ASB security features

Aside from the standards like 2FA and Face ID, ASB has made some exciting announcements in 2025 designed to keep Kiwis safer when banking or shopping online.

Caller Check

Caller Check is ASB’s latest innovation in its fight against scammers. The tool helps protect customers from impersonation scams by allowing ASB customers to confirm they’re speaking with an actual ASB employee when they receive a call from the bank. This is done using a push notification from the ASB Mobile Banking App. Scammers will often call victims claiming to be from trusted organisations, including banks. This feature allows you to verify that simply and easily, using a trusted app already on your device.

24/7 Fraud Line

Although launched in 2024, the ASB 24/7 fraud line is a great resource for customers who require urgent help. The helpline is able to provide advice and assistance to victims and potential victims around the clock.

New Westpac security features

ASB is not the only bank to roll out new security features and tools designed to keep its customers safe. Westpac Bank has improved online shopping security for its customers with its latest security tool.

Digital Westpac Card

A digital card has a few benefits to users, including convenience and accessibility but the main drawcard is the added security provided by a dynamic security code. This replaces your regular 3-digit CVC on the back of your card and changes every 24 hours in the Westpac One app. This means you can shop with extra peace of mind, knowing that if your card details are entered into an unsafe website or recorded by scammers, they won’t be able to continue shopping with your card details once the CVC resets. Westpac is the first New Zealand Bank to offer a dynamic security code feature alongside instant issuance for debit cards.

24/7 Helpline

Just like ASB, Westpac bank also has a 24/7 helpline for urgent assistance. Meaning as soon as you are suspicious that something isn’t quite right, you can reach out to the bank and get things sorted.

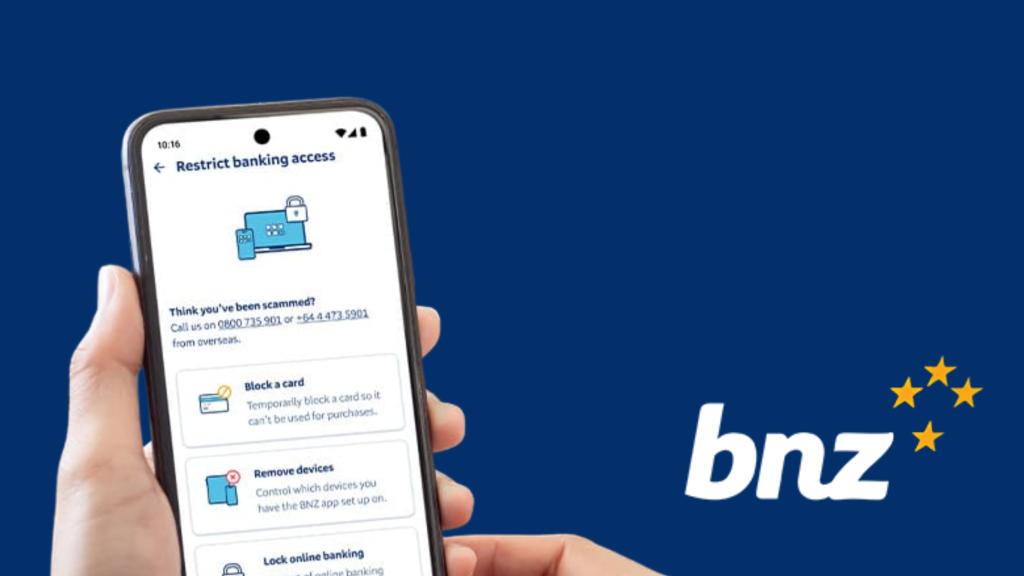

Recent BNZ Internet Banking Security Improvements

BNZ also has some great security features that go above the likes of 2FA and in-app card blocking. Their biggest new features were introduced late last year and are designed to improve customer safety and reduce the number of successful scam attacks.

Online Banking Lock

This feature lets customers disable all online banking activity if they suspect a scammer has gained access to their accounts. BNZ says “While anyone who suspects they’re the victim of a scammer should always call their bank immediately, this tool gives customers the ability to lock their online banking while they’re making the call.”

To regain access, customers must verify their identity in a branch. This is a great feature with instant results, saving precious seconds in the important time immediately following or during a scam attack.

Voice identification

Again, not an entirely new feature but one that is sure to provide some peace of mind. BNZ has extra protection when you call to speak with the Contact Centre. This is in the form of a pre-set voice identification, allowing the bank to securely identify callers.

No More NetGuard

NetGuard cards were seen as a breakthrough for internet banking security in 2006 when they were first launched. Of course in the nearly 20 years since then the online banking landscape has changed a lot. BNZ has used an app-based system to authenticate logins since 2012 but has only recently scrapped the NetGuard option altogether.

ANZ Security Features

ANZ has a stack of security features designed to keep internet banking users and online shoppers safe. These include their versions of some of the features mentioned above.

ANZ Dynamic Security Code

This feature is the same as Westpac’s, with the changing CVC number, however ANZ’s option has a shorter window, changing every 12 hours. This acts as an extra layer of protection for your ANZ Visa card when shopping online.

Control How Your Card Can Be Used

One interesting security feature that not every bank has is the ability to turn off certain types of purchasing. In the ANZ goMoney app, users can turn on and off online shopping, overseas in-person purchases, contactless and online gambling purchases.

This gives you peace of mind and added security by limiting what exactly a scammer could do if they gained access to your card details.

Biometric identification

You may have seen videos of this online already. ANZ has numerous options for biometric identification, including Voice ID. Voice ID allows you to log in to ANZ Phone Banking or identify yourself with our contact centre with your own unique and secure voiceprint. This is a great extra layer of security, especially if you prefer to do your regular banking over the phone. It can also give you extra security when making payments above $10,000 in the ANZ goMoney app, by verifying your identity using your unique voiceprint.

Other Good News

Even if you didn’t see your bank mentioned, chances are they have some great security features in place. All of New Zealand’s major banks have 24/7 monitoring, keeping an eye out for suspicious transactions. Most banks now require some form of two-factor authentication. Most also have some form of guarantee or protection in the event you are scammed through no fault of your own. There will be terms and conditions with these, so make sure you’re complying with them whenever you’re using your cards or accessing your accounts.

Need help identifying scams?

In today’s rapidly evolving digital world, online safety has never been more important. At Geeks on Wheels, we understand the need for a reliable defence against the ever-growing threat of online scams. That’s why we’ve developed GeekSafe™ – a membership designed to empower you. Providing the tools and knowledge to stay safe online, ensuring you can browse, email, and connect with confidence. For just $85 A YEAR, you can unlock a world of online safety knowledge and protection.